How Avrex IO Works

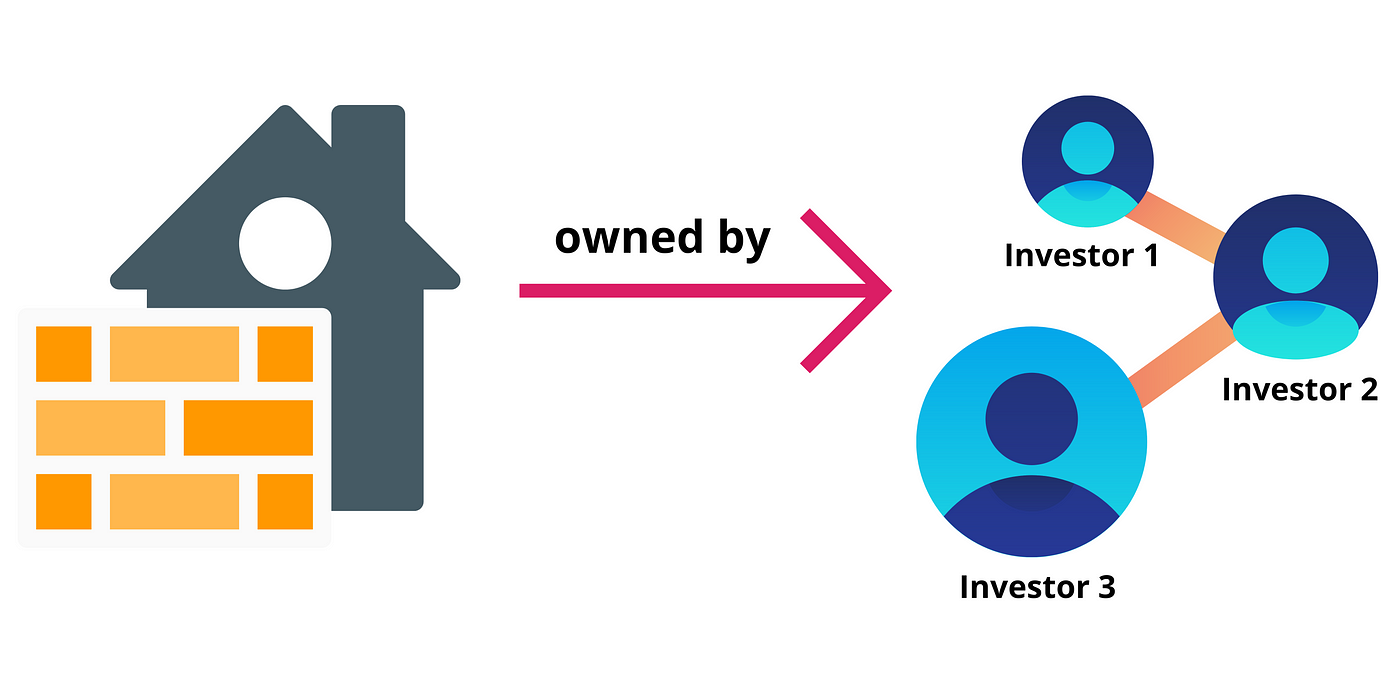

Real estate tokenization converts the value of real estate into a token stored on a blockchain, enabling digital ownership and transfer. These divisible tokens each present a fractional share of the ownership stake in that real estate. At Avrex IO, we believe that the tokenization of assets is the next logical step in the technological evolution of commerce, particularly when it comes to the real estate market. This paradigm shift, towards tokenization, will enable us to transcend the fiat-currency-centered view of economics into a more democratic, inclusive, and efficient token economy.

Avrex IO is a platform that tokenizes ownership of rental properties. We enable you to access property ownership starting from as low as $100 (we are developing tools that will permit the reduction of onboarding costs)! Thus, you can buy and sell in just a few clicks via tokens representing shares in the legal entity that owns our growing real estate portfolio. This allows you to benefit like an owner; rental income, appreciation of the asset, and have a say in the management of the property

How Avrex IO works

Today, assets can be represented on a blockchain by a distinctive digital identifier called a token. Tokenization is a method that converts rights to an asset into a digital token, in many ways similar to the traditional process of securitization.

We offer fractional and frictionless real estate investing ensuring investors around the globe can buy into the real estate market through fully-compliant, fractional, tokenized ownership Powered by blockchain. These are actual properties, which we have verified, curated, and sometimes renovated to meet the modern standard.

This means a group of investors can co-own property and its rents will be split amongst them weekly as cash-flowing revenue. The investors receive a contact and prove of ownership, this serves as security and symbolizes the exact property and how many shares they own in it. Each investor has a right to the building and can participate in votes and decision-making of the property they invest in. We have simplified the process and are working with multiple property management companies, each for a particular property. They ensure these properties are well managed, tenants pay rent on time, and properties are always fully occupied.

The Benefits of Asset Tokenization

The foundation of a token economy offers the potential for a more efficient and fair financial world by greatly reducing the friction involved in the creation, buying, and selling of securities. Features like integrity, robustness, accessibility, and immutability, make blockchain a powerful accounting tool. The process of asset tokenization creates a myriad of advantages, including greater transparency, liquidity, and accessibility as well as faster and cheaper transactions.

Greater Transparency

A security token can have the token holder’s rights and legal responsibilities embedded directly into the token, along with an immutable record of ownership. This immutable record means that nobody can “erase” your ownership even if it is not registered in a government-run registry. These characteristics promise to add transparency by tracking and recording the history of the asset every single time it changes hands.

Increased Liquidity

The tokenization of assets creates a more liquid world and drastically changes the dynamics of global trade. Tokenizing assets — especially private securities or typically illiquid assets such as real estate — enables them to be more easily traded on a secondary market of the issuer’s choice. What’s more, access to a broader base of investors increases the liquidity of these assets, benefiting investors who consequently have more freedom and sellers because the tokens benefit from the “liquidity premium” thereby capturing greater value from the underlying asset.

Globalization

When the tokenization of assets reaches the mainstream, the global trade of (previously) illiquid physical assets could become an everyday reality. As assets become increasingly tokenized, global trade becomes less difficult, and an opportunity for developing new markets for previously underutilized, illiquid assets opens up. As a result, people from different corners of the world can own fractions of the same physical asset or exchange different kinds of assets directly and instantly.

No geographic limit

Property tokenization, like any type of tokenization, eliminates barriers related to location. Avrex IO eliminates barriers related to location, nothing prevents you from buying a property on the other side of the world in the middle of the night

Reduced Barriers To Entry

Importantly, tokenization opens up the investment of assets to a much wider audience — thanks to reduced minimum investment amounts and periods. Tokens are highly divisible, meaning investors can purchase tokens that represent small percentages of the underlying asset. If each order is cheaper and easier to process, it will open the way to a significant reduction of minimum investment amounts. At Avrex IO, a single token starts at $100, and one can own up to 2500 Tokens ($250,000) in a single property. You can as well own as many properties as possible.

At Avrex IO, we are proud to help build the infrastructure to support the growth of a new token economy enabling anyone from anywhere to own rental properties and earn from an array of properties in our marketplace. Generate a rental income weekly from numerous properties while you relax at home.

View Marketplace

What is a Token?

A token is a virtual asset issued on the blockchain. It can be used in different cases!

In our case, it is a share of the company that owns the property.

By investing in a property on our marketplace, you are purchasing Tokens (shares) of that property and you receive rents in proportion to the number of tokens purchased. Your ownership stake (Tokens) appreciates as the property appreciates and you can sell back tokens at will even at a higher price than purchased.

Profit is made in 3 ways simultaneously:

Through rents which are dispersed among investors weekly (short-term). This is paid in proportion to the stake you own in the property.

As the property value appreciates, an investor can sell his/her share at a higher price than they initially purchased at any time (long-term).

Through our affiliate program, you can make up to 10% off every deposit made using your referral link. This includes a lifetime cookie

Our Aims and Goals

Our goal is to revolutionize real estate investing and make it as simple as investing in stocks or crypto. Diversification is key to any investment strategy, but the barrier to entry for real estate investing has always been so high. We don’t believe that should be the case.